Financing Sustainable Energy as–a-Service: Why it’s gaining traction in Switzerland

Date

April 25, 2025

Insights

The shift towards as-a-service business models is transforming industries worldwide, offering a more accessible and efficient way to adopt sustainable energy solutions. By eliminating the need for large upfront capital investments, these models spare businesses high capital expenditures (CapEx) to acquire cutting-edge technology, instead allowing adoption through manageable operational expenses (OpEx). Under this model, service providers retain ownership of the energy systems, taking full responsibility for their operation, maintenance, and upgrades, therefore removing technical barriers for end-users. This approach, incentivising long-term optimal performance, also encourages the optimal design of technologies and the efficient use of the engaged resources in the long run.

Given these advantages, the as-a-service model holds significant potential for accelerating the energy transition. Whether applied to heating, cooling, lighting, or decentralised renewable energy systems, this approach enables faster deployment of clean energy technologies while ensuring long-term performance and cost savings. By shifting financial and technical risks away from the end-user and onto specialised service providers, the model can unlock the much-needed adoption of energy-efficient and low-carbon solutions.

Switzerland is seeing growing momentum around the integration of as-a-service models in the energy sector. From buildings to industrial applications, businesses and financiers are recognising the value of this approach. This article highlights key projects that showcase how the model is being implemented and why it is gaining traction among financial stakeholders.

Sustainable Energy as-a-service in Switzerland, a momentum driving decarbonisation across sectors

Despite progress over the last decades, as of 2023 fossil fuels still represent the largest share of the Swiss energy mix (43%), and solar remains a very minor contributor, amounting to 5%. As the country is still planning to gradually phase out the production of nuclear power, it is urgent to accelerate the shift to solar, wind, biomass, and geothermal energy to complement hydropower and maintain a reliable, sustainable power grid.

Several barriers hinder widespread adoption, including high upfront costs, policy gaps, and technical challenges, making it difficult for businesses and households to fully transition. Addressing these obstacles through financial incentives, regulatory support, and workforce development will be crucial in accelerating the shift toward a low-carbon future.

To circumvent some of these key obstacles, a growing adoption of the as-a-service model for sustainable energy has been witnessed in the country. Solar power, in particular, has seen a rapid expansion due to supportive policies and as Power Purchase Agreements became popular in the broader European context. These solar-as-a-service models, where customers pay for the energy produced rather than owning the system, have made solar installations more accessible for businesses and households, driving deployment without requiring high upfront investment. While solar leads the transition, other technologies like heating, cooling, lighting, and energy storage hold significant potential but face slower adoption due to several barriers to deployment which include: a more complex business model, managerial changes and operational changes; indeed Solar as a Service is very similar to how customers purchase electricity today – we do not own the utility generating electricity, we just purchase and consume it.

Frigg and Voltiris, sparking progress their own way

Frigg: channelling investments into renewable energy through Energy-as-a-Service models

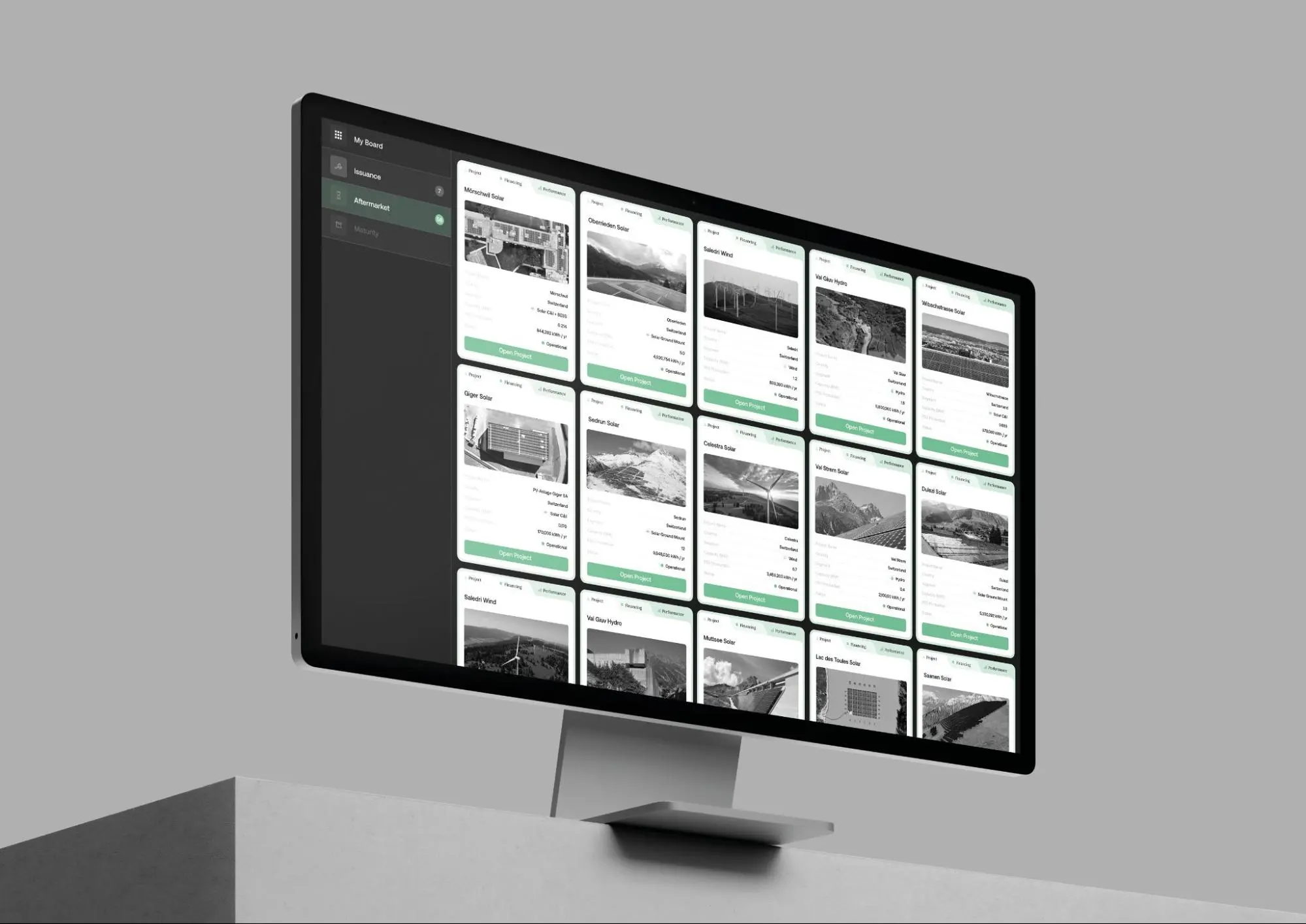

Frigg, a Swiss-based software company, unlocks renewable energy development by removing financial barriers. By bundling financial services with cutting-edge digital technology, the company facilitates investments in renewable energy projects. Small and medium-sized projects (typically under 50 MW of capacity) often struggle to access capital due to high transaction costs and limited investor visibility. To solve this challenge, Frigg developed a user-friendly platform connecting carefully curated projects from around the world with institutional investors. Leveraging automated due diligence, the team enables investors to easily assess the risk-return profiles of the projects and invest in them through debt or equity instruments created by the platform.

This innovative marketplace enables project owners to transparently document their projects and structure their financing needs in an investor-ready format, creating a pipeline of financeable opportunities.

The solution supports the deployment of sustainable Energy-as-a-Service models, often backed by long-term Power Purchase Agreements (PPAs). By allowing investors to cover the upfront costs of the system installation, it enables end-users to access cleaner energy sources on a pay-per-use basis, overcoming typical financing barriers. Ultimately, such models help Switzerland scale renewable energy production while creating a new asset class for investors.

For instance, Frigg recently helped a project developer that owns multiple solar rooftop projects by enabling them to raise debt financing on their existing projects, to finance the development of new installations elsewhere. A first batch of several small projects (around 0.3 MW of capacity each) was bundled into one loan, allowing transaction costs to be reduced through economies of scale. Each of the solar rooftop projects sells its produced energy through PPAs contracted with local businesses, enabling these businesses to use clean, local energy without worrying about the construction costs of the underlying solar systems.

Frigg investor dashboard, showing renewable energy project opportunities to invest in.

Key aspects of Frigg’s technology include:

- Streamlined documentation and due diligence: documentation and analysis time is reduced from ~6 months to 1 week thanks to Frigg’s digital workflows.

- Real-time technical, financial, and environmental monitoring: transparency is enhanced through connections to IoT devices on the projects, enabling the platform to monitor the technical performance (kWh) while deriving key financial and environmental impact metrics.

- Lower transaction costs: through disintermediation and technology, the cost of such transactions is reduced by an average factor of x10. Notably, the use of blockchain technology allows for more flexibility and better-suited financing structures.

“Renewable energy has been left behind by traditional finance through ill-suited documentation & due diligence processes, and exorbitant transaction costs. By leveraging technology and financial engineering in a platform specifically built for these projects, we enable developers to scale sustainable infrastructure while offering attractive opportunities to investors backed by real, stable, long-term cash flows.”

-Philip Berntsen, CEO Frigg

Voltiris: Solar Panels-as-a-Service for Swiss Greenhouses

Voltiris, a Swiss startup founded in 2022, is transforming agriculture with a solar-as-a-service model tailored for greenhouses. Their innovative photovoltaic modules selectively filter sunlight, allowing plants to receive the wavelengths essential for photosynthesis while converting the rest into electricity. This unique technology lowers energy costs by up to 30%, helps farmers cover up to 70% of their energy needs, and can reduce CO₂ emissions by up to 1,000 tons per hectare. By providing solar-as-a-service to Swiss farmers, Voltiris enables the agricultural sector to embrace clean energy without disrupting food production.

Several key aspects of Voltiris technology includes:

- Spectral Filtering: Voltiris’s modules filter sunlight, allowing wavelengths essential for photosynthesis to reach plants while directing unused wavelengths to high-efficiency solar cells for electricity generation.

- Cost Efficiency: By generating their own electricity, operators can reduce energy costs by up to 30%, enhancing profitability.

- Seamless Integration: The modules are compatible with most greenhouse equipment, require minimal maintenance, and can be installed without special permits, facilitating easy adoption by growers.

“Our energy-as-a-service model eliminates the biggest hurdle for growers to adopt sustainable energy: the heavy upfront investment. At the same time, we unlock a vast, underutilised surface for solar deployment—greenhouses—offering infrastructure investors scalable access to solar in a world where available land is increasingly scarce.”

-Nicolas Weber, CEO Voltiris

Voltiris’ solar panels installed in a greenhouse

Financing Energy-as-a-Service: A Growing Opportunity for Impact Investors

For impact investors, EaaS presents a compelling opportunity as it aligns financial returns with measurable environmental and sometimes social benefits. As financial institutions and governments seek solutions to meet net-zero targets, investments in solar, heating, cooling, and storage-as-a-service are becoming increasingly attractive to decarbonise the built environment. Investing in EaaS projects involves providing energy service providers with financing solutions to compensate for the delivery of cleaner technologies charged to the client on a pay-per-use basis. Several financial models apply:

- A provider can raise debt to deploy the asset on a customer’s premises

- A provider can adopt a sales-leaseback scheme, whereby the equipment is sold to a financier while the provider retains control over it.

- The provider can set up a Special Purpose Vehicle and finance it with external partners.

- The provider can “sell the receivables” of a contract with an end-customer to finance the project deployment.

For financial institutions, EaaS models offer strong financial and impact-driven benefits, such as:

- Stable, predictable returns: recurring payments from businesses ensure steady cash flows, reducing market volatility risks.

- High transparency & traceability: digital platforms and IoT-based energy monitoring allow investors to track project performance, energy savings, and carbon reductions in real-time and with significant accuracy.

- Scalable climate impact: by financing energy-efficient and renewable solutions, investors contribute to emission reductions and help businesses decarbonise operations.

As businesses, municipalities, and industries seek cost-effective, low-risk pathways to cleaner energy, the demand for EaaS solutions will only continue to grow.

However, to fully unlock EaaS’s potential, further efforts are needed to scale financing mechanisms, enhance policy support, and expand adoption beyond solar into heating, cooling, storage, and industrial efficiency. Increased collaboration between investors, policymakers, and energy innovators will be essential to drive widespread uptake.